What is IDWise?

IDWise stands out as an innovative AI-driven identity verification tool designed to help businesses streamline the customer onboarding process. By utilizing cutting-edge technology, IDWise efficiently validates user identities through features such as government-issued ID recognition, facial matching, compliance with e-KYC and AML regulations, and address verification.

How to use IDWise?

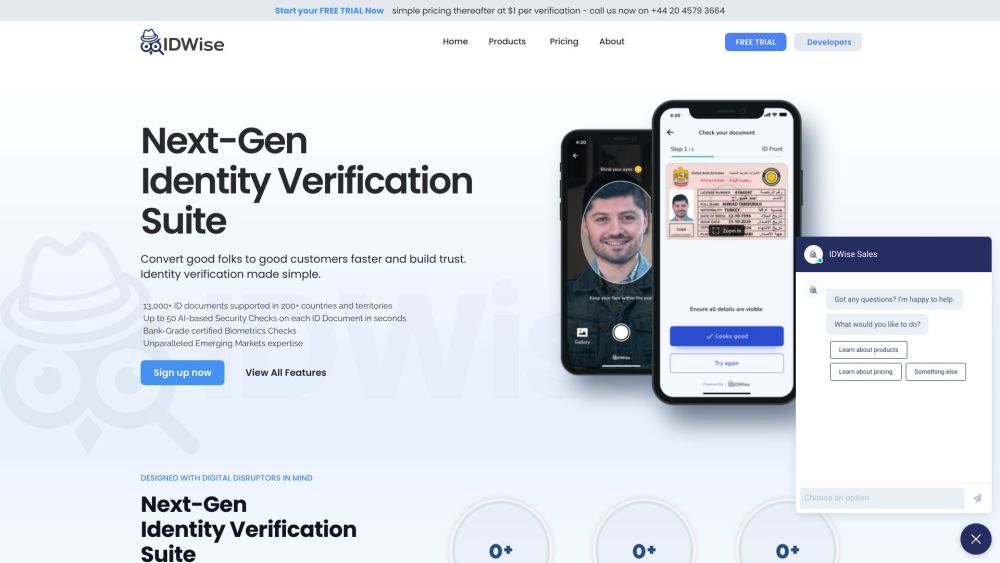

Getting started with IDWise is simple and intuitive. Follow these straightforward steps: 1. Capture the ID Document: Customers can easily take a clear picture of their government-issued ID using their smartphone. The AI-enhanced auto-capture feature of IDWise assists them in this process smoothly. 2. Snap a Selfie: The system conducts a facial comparison to ensure that the individual in the ID matches the one in the selfie. Additionally, it performs liveness detection to verify the physical presence of the ID holder. 3. Complete Onboarding: In just a few seconds, IDWise utilizes its advanced AI technology to confirm the identity by conducting a series of checks, including document validation and AML screenings. Upon successful verification, the customer is officially onboarded.

IDWise's Key Features

Rapid recognition and validation of government-issued ID documents

Facial verification ensuring identity match through live selfies

Comprehensive e-KYC and AML compliance to combat financial crimes

Address verification to mitigate fraud and money laundering risks

AI-driven technology that executes over 50 security checks per ID

Support for a vast array of ID documents across 200+ countries

Bank-grade biometric checks ensuring top-tier security

Specialization in identity verification for emerging markets

Effortless and automated identity verification experience

Easy integration with various platforms and systems

IDWise's Use Cases

Efficient customer onboarding

Identity verification for online purchases

AML compliance solutions for financial sectors

Fraud prevention and KYC/AML adherence across diverse industries

-

IDWise Support & Customer Contact

For additional inquiries, please visit the contact page(https://www.idwise.com/get-in-touch/).

-

About IDWise

Company Name: IDWise® Ltd.

Learn more about IDWise by visiting the about us page(https://www.idwise.com/aboutus).

-

IDWise Pricing Details

For pricing information, visit https://www.idwise.com/pricing/.

FAQ from IDWise

What is IDWise?

IDWise is an advanced AI-driven identity verification platform that allows businesses to onboard customers quickly and securely by verifying their identities. The solution includes features such as government-issued ID recognition, facial verification, compliance with e-KYC & AML, and address validation.

How to use IDWise?

To utilize IDWise, simply follow these steps: 1. Capture a photo of the ID Document: Customers can take a clear image of their government-issued ID using a mobile device, guided by IDWise's smart auto-capture feature. 2. Take a Selfie: IDWise compares the face from the ID with the live selfie, ensuring a match, and checks for liveness to confirm the person's presence. 3. Onboard the Customer: IDWise verifies the identity swiftly, conducting various checks like document validation and AML screening, successfully onboarding the customer.

How does IDWise work?

IDWise operates by allowing users to photograph their ID and take a selfie. Its AI technology conducts checks such as facial matching, liveness detection, document validation, and AML screening, verifying the user's identity in seconds.

What are the core features of IDWise?

IDWise offers a range of features, including government-issued ID recognition, facial verification, e-KYC and AML compliance, and proof of address verification. It encompasses over 50 security checks for each ID, supports a diverse range of ID documents globally, provides bank-grade biometric checks, and has a focus on emerging markets.

What are the use cases of IDWise?

IDWise is applicable for customer onboarding, identity verification in online transactions, AML compliance in financial services, and KYC/AML compliance and fraud prevention in diverse sectors.