What is Uprise?

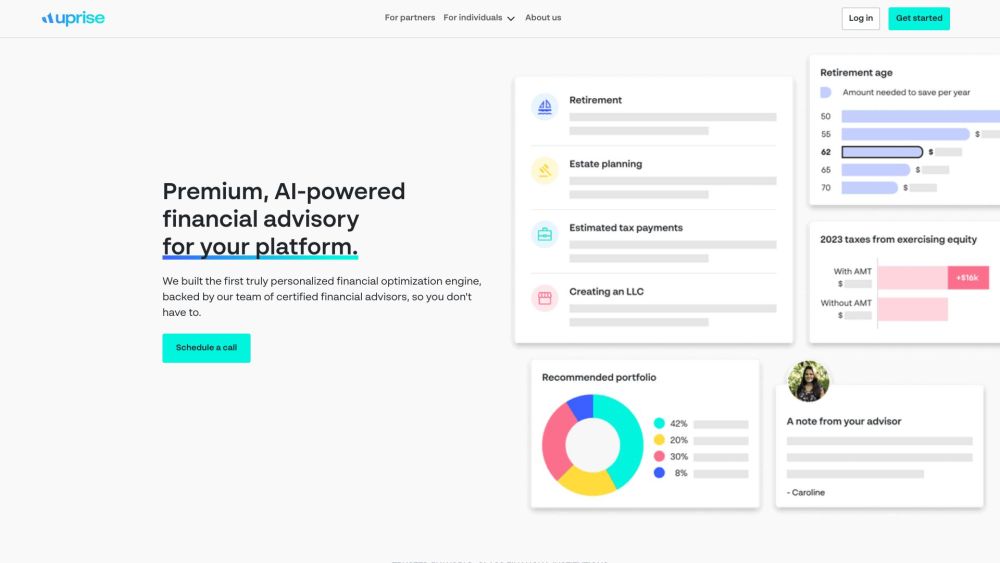

Uprise redefines financial intelligence—blending cutting-edge AI with human expertise to deliver precision-tailored financial optimization. More than a robo-advisor, it's a premium, end-to-end platform engineered for clarity, confidence, and control. Backed by SEC-registered advisors and governed by fiduciary standards, Uprise empowers individuals to build resilient financial futures—and equips partners to embed trusted, compliant advisory capabilities directly into their ecosystems.

How to use Uprise?

Getting started with Uprise is intuitive and purpose-built for your role. Individuals complete a secure onboarding flow to unlock dynamic financial insights, goal-based planning tools, and real-time access to certified advisors—via chat or scheduled sessions. For fintechs, banks, and enterprise platforms, Uprise offers fully white-labeled advisory modules or modular API integrations—pre-certified for regulatory alignment (SEC, FINRA, GDPR), so you scale trust—not compliance risk.