FAQ from SimFin

What is SimFin?

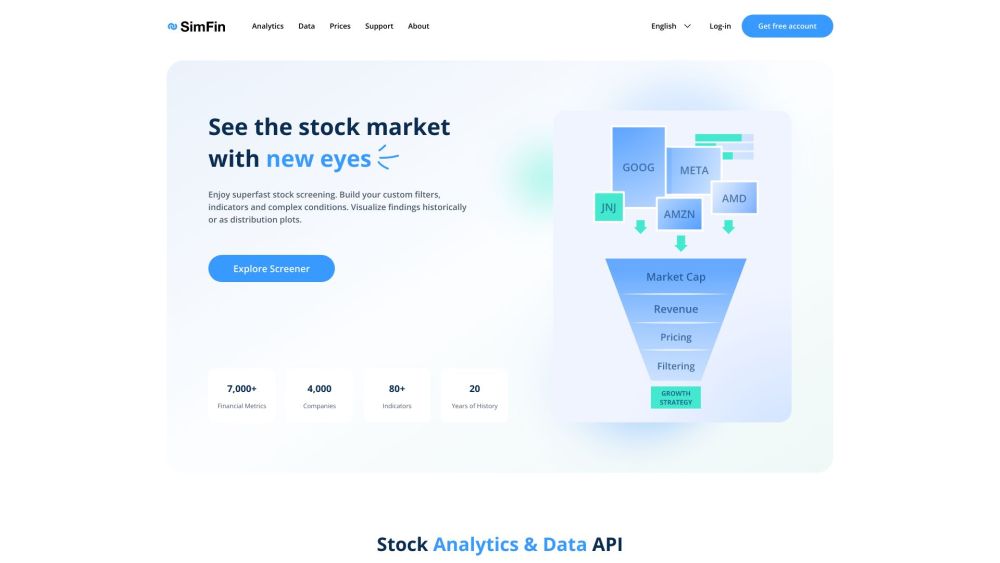

SimFin is an AI-enhanced platform that delivers in-depth stock analysis and financial data for investors and analysts. It offers tools for screening, backtesting, and visualizing market data across a broad universe of equities, empowering users to develop smarter investment strategies using reliable, transparent information.

How to use SimFin?

Users begin by creating a free account, which grants immediate access to essential tools. From there, they can run custom stock screens, simulate investment strategies using historical data, generate performance reports, and export datasets for further analysis. Tutorials and support resources help guide new users through each step of the process.

What type of accounts is SimFin offering?

SimFin provides three account tiers: FREE, BASIC, and PRO. The FREE plan includes access to key features and limited data downloads. Paid plans (BASIC and PRO) offer faster data retrieval, expanded export options, and enhanced functionality tailored to active traders and institutional users.

Who are the investors of SimFin?

In 2022, SimFin secured funding from IBG Risikokapitalfonds, managed by bmp Ventures—a venture capital firm focused on supporting innovative startups in the Saxony-Anhalt region of Germany.

Why are there more US stocks listed than European stocks on SimFin?

The platform prioritized completing the full historical dataset for U.S. markets first, aiming for completion by Q1 2023. Expansion to European exchanges was targeted for late 2023, followed by Asian markets in 2024 as part of its global data rollout roadmap.

What is a stock screener?

A stock screener helps investors filter large universes of securities based on financial ratios, growth metrics, market caps, or custom conditions. SimFin's screener supports complex queries, percentile rankings, and real-time visualization to uncover hidden opportunities.

What is backtesting of investment strategies?

Backtesting involves applying an investment strategy to historical price and financial data to estimate how it would have performed in past market conditions. This helps validate ideas before deploying capital in live markets.

How can I get help for the SimFin tools?

SimFin offers a dedicated support section with video guides, written tutorials, and best practice recommendations. These resources assist users in mastering the platform’s tools and maximizing their analytical potential.

Do I have to pay for a SimFin account?

No—SimFin offers a fully functional FREE account. For those needing higher data throughput or advanced features, paid subscriptions (BASIC and PRO) are available with scalable benefits.

Is SimFin a German company?

Yes, SimFin Analytics GmbH is headquartered in Halle (Saale), Germany, and operates under German ownership, serving a global user base with localized data expansion plans.