What is MindBridge AI?

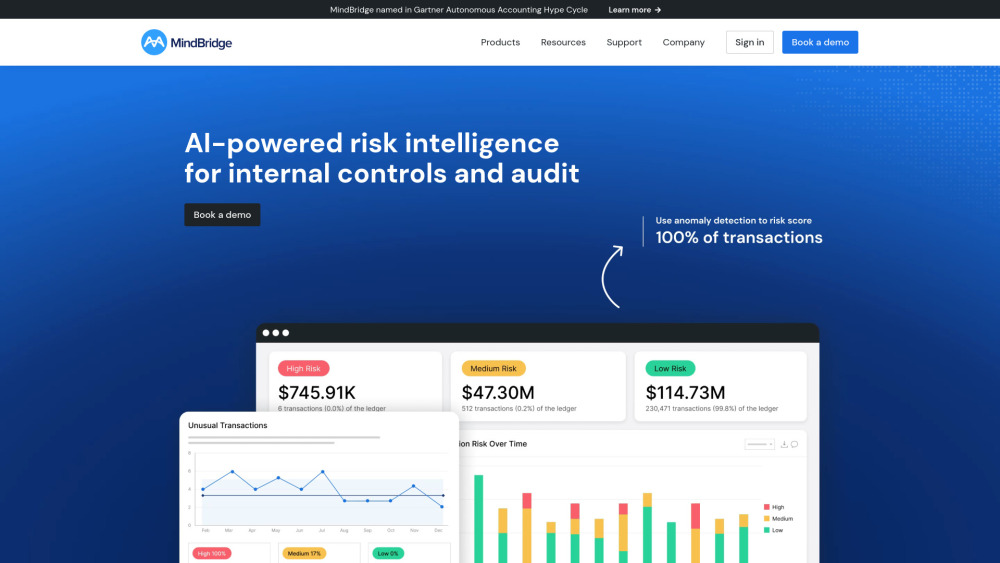

MindBridge AI stands at the forefront of financial risk identification and anomaly detection. This innovative platform empowers finance professionals by streamlining their ability to discover, highlight, and assess risks within extensive financial datasets.

How to use MindBridge AI?

Users can utilize MindBridge AI to automate the examination of all financial transactions, drawing attention to any irregularities and enhancing control mechanisms to facilitate informed decision-making.