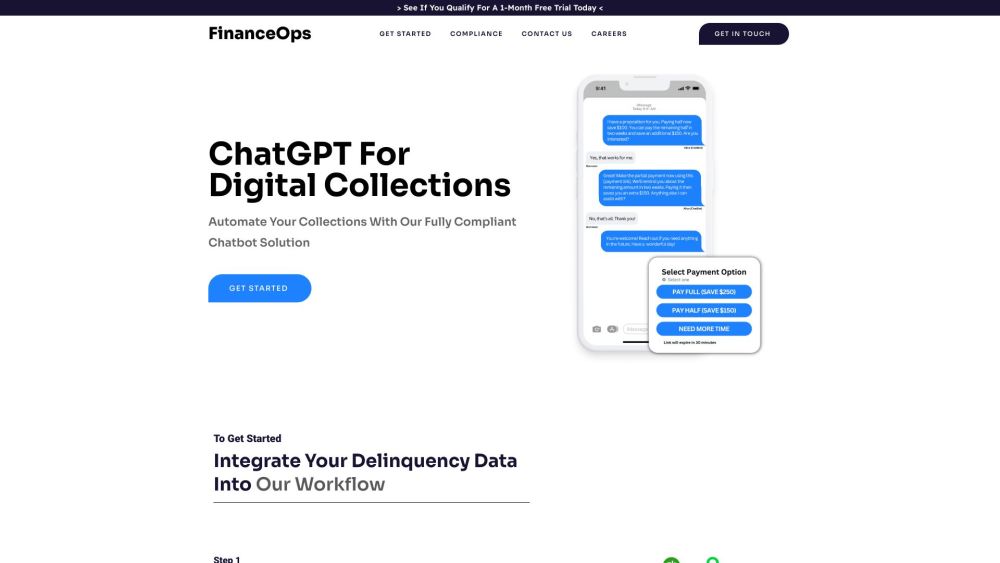

What is FinanceOps: AI Tool for Automating Collections?

FinanceOps is an innovative financial operations platform that utilizes artificial intelligence to automate collections processes. This powerful AI tool seamlessly integrates with popular ERP tools, leveraging advanced algorithms to optimize collections and maximize results. By streamlining collections, FinanceOps delivers targeted interactions, reduces overhead expenses, accommodates increased volumes, and ensures compliance with US debt collection rules and laws.

How to use FinanceOps: AI Tool for Automating Collections?

Using FinanceOps is simple and efficient. Follow these steps to harness the power of this AI tool: 1. Connect your ERP tool: If you already use an integrated ERP tool, seamlessly connect it to FinanceOps. 2. Integrate delinquency data: Map and configure your customer delinquency data from ERP tools like QuickBooks, Xero, Sage, NetSuite, Salesforce, etc., into the FinanceOps dashboard. 3. Customize collection settings: Personalize your collection settings, including tone, loan criteria, and settlement limits, to tailor the approach according to your specific needs. 4. Launch Autopilot: Let FinanceOps take charge with its intelligent system. It employs advanced algorithms and personalized strategies to optimize collections and engage with customers effectively.